Ethereum price USD is one of the most searched topics by people interested in cryptocurrency. Many want to know if the price of Ethereum in USD will go up or down, as this can help them make smarter choices. Understanding how Ethereum’s price changes can be a big help for both beginners and experienced investors.

Ethereum is a popular digital currency, like Bitcoin, that many people use to trade and invest in. Unlike regular money, it isn’t controlled by any country or bank. Instead, Ethereum runs on a unique technology called blockchain. This helps keep transactions safe and makes it possible for people around the world to buy and sell Ethereum without needing a middleman. Knowing the current Ethereum Price USD is important, as it can change quickly based on demand, news, and even technology updates.

What Is Ethereum, and How Is Ethereum Price USD Determined?

Ethereum is a popular cryptocurrency, much like Bitcoin, but it works differently. The Ethereum price USD depends on various things, such as supply and demand, technology, and market interest. Every day, thousands of people trade Ethereum, causing its USD price to change constantly. When demand for Ethereum is high, the price in USD goes up. This can happen if more people believe in its value or if there is exciting news about it.

When fewer people are interested, the price may drop. Because of this, knowing what Ethereum is and how its price in USD changes can help you make smart choices when trading. Another factor affecting the Ethereum price in USD is the number of Ethereum coins available. Unlike regular money, cryptocurrencies like Ethereum have a fixed supply. This limited number makes Ethereum valuable, as it’s not easy to get. This scarcity is one reason why people pay close attention to the price of Ethereum in USD.

Why Does Ethereum Price USD Change So Often?

Ethereum price USD changes frequently because it’s influenced by global events, technological updates, and even changes in interest from investors. One reason for this fluctuation is that Ethereum is decentralized, meaning it isn’t controlled by any single entity, like a bank or government. The demand for Ethereum can change based on news and developments. For example, if new technology or partnerships are announced, more people may want to buy

Ethereum, increasing the USD price. On the other hand, if there’s negative news or security concerns, fewer people may want to invest, causing the price to drop. Another reason Ethereum’s price in USD changes is due to competition from other cryptocurrencies. Many digital coins are available, each offering unique features. When a new cryptocurrency gains popularity, it can affect the demand for Ethereum, making the price in USD go up or down.

How to Check the Latest Ethereum Price USD

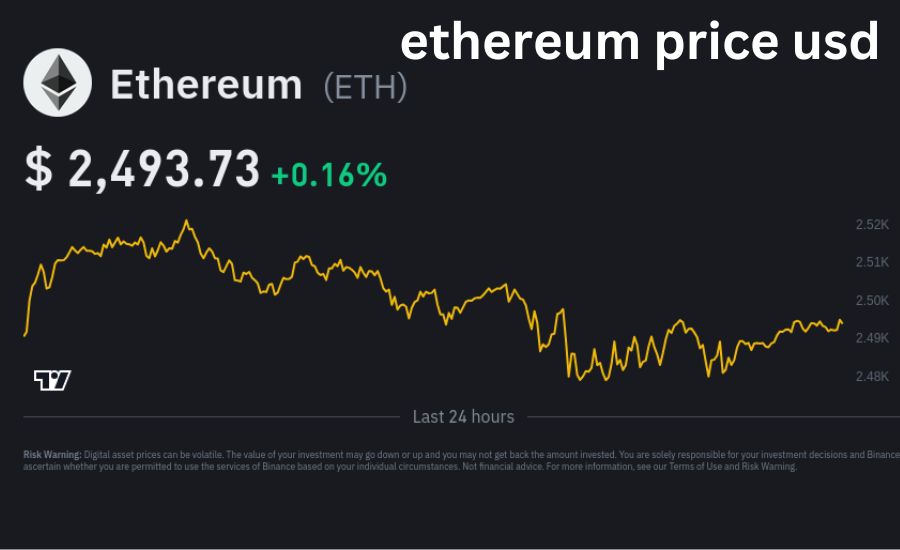

There are many ways to check the latest Ethereum price USD, and it’s essential to use reliable sources. Some popular platforms include cryptocurrency exchanges, financial news websites, and mobile apps that offer real-time price updates. One easy way to keep track of the Ethereum price in USD is by using a smartphone app. Many apps allow you to set alerts, so you’re notified when the price reaches a certain level.

This way, you can make quick decisions about buying or selling. Websites like CoinMarketCap and Binance are also popular for checking prices. These sites provide up-to-the-minute information on Ethereum and other cryptocurrencies, helping you make informed choices. Checking the Ethereum price in USD daily can be helpful, especially if you plan to invest or trade regularly.

Is It the Right Time to Invest in Ethereum Price USD?

Investing in Ethereum is a popular choice, but deciding when to buy can be challenging. The right time to invest in Ethereum price USD often depends on the market conditions and your personal goals. Sometimes, the price is low, and this can be a good opportunity to buy if you believe Ethereum’s value will increase over time. Many people choose to buy Ethereum when the USD price is low, thinking they’ll sell it when the price rises.

However, predicting the perfect time to invest is difficult since prices change quickly. Some investors buy a little at a time to avoid the risk of buying at a high price. If you believe in the technology and the growth of Ethereum, you may feel more confident holding it long-term, regardless of short-term price changes. It’s crucial to remember that any investment comes with risks, so learning about the factors influencing Ethereum price USD can help you decide when to enter the market.

Factors That Cause Ethereum Price USD to Rise and Fall

Several factors influence the Ethereum price USD. One major factor is supply and demand; when many people want to buy Ethereum, the price goes up. If fewer people are interested, the price drops. This happens daily, making the price of Ethereum in USD fluctuate frequently. The news can also impact the Ethereum price in USD. For instance, if there’s news about a new feature or partnership, it might create excitement, and more people might buy Ethereum.

Negative news, like security breaches, can reduce demand and lower the price. Staying informed about news and trends can help investors understand why the price changes. Another factor is competition with other cryptocurrencies. If a new digital currency becomes popular, it might reduce interest in Ethereum, affecting its USD price. Similarly, changes in government regulations around the world can impact Ethereum’s price, as more rules can either limit or boost its value.

How Ethereum Price USD Compares to Bitcoin

Ethereum and Bitcoin are two of the most well-known cryptocurrencies, and many people wonder how their USD prices compare. Although both are digital currencies, their values can differ greatly. Bitcoin usually has a higher Ethereum price USD, but that doesn’t mean Ethereum is less valuable. One key difference is the purpose of each cryptocurrency. Bitcoin is often seen as digital gold, mainly used for storing value. In contrast, Ethereum is used for more complex projects, such as building decentralized apps and smart contracts.

This gives Ethereum unique value and sometimes causes its USD price to increase independently of Bitcoin. Ethereum’s price in USD is also more influenced by technological updates than Bitcoin. For example, if a new upgrade is added to Ethereum’s blockchain, it might increase its value. This is different from Bitcoin, which has fewer technological changes. Understanding these differences can help investors make better decisions when comparing the USD prices of Ethereum and Bitcoin.

Simple Steps to Start Investing in Ethereum Price USD

If you’re ready to invest in Ethereum, there are some simple steps to follow. First, choose a reliable cryptocurrency exchange where you can buy Ethereum in exchange for USD. Some popular exchanges include Coinbase, Binance, and Kraken, where you can create an account and deposit money. Next, decide how much you want to invest. For beginners, starting small is often safer, as Ethereum’s price in USD can fluctuate.

Once you’ve bought Ethereum, you can either keep it on the exchange or transfer it to a digital wallet for extra security. Digital wallets, like MetaMask, help protect your Ethereum from online threats. After buying, keep an eye on the Ethereum price USD if you plan to trade or sell. Many investors use mobile apps to track price changes and set alerts for when the price reaches a specific value. Investing in Ethereum can be simple if you start with a plan and stay updated on its USD price changes.

Why Many Investors Focus on Ethereum Price USD

Ethereum is popular among investors, and many people closely watch its price in USD. One reason is that Ethereum has a unique blockchain platform that supports a wide range of projects. This diversity attracts investors who see potential in Ethereum beyond just being a currency. Unlike some other cryptocurrencies, Ethereum’s blockchain allows for decentralized apps and smart contracts.

These features make Ethereum valuable for more than just trading, as many industries use Ethereum’s technology for innovative projects. This widespread use is why investors pay attention to Ethereum price USD. Additionally, Ethereum’s market cap, or total value, is high, making it one of the top cryptocurrencies. This high rank gives investors more confidence in its future.

How News and Events Affect Ethereum Price USD

News and events play a big role in changing Ethereum price USD. Positive news, such as technological upgrades or new partnerships, can lead to more interest in Ethereum, causing the price to rise. For instance, announcements about Ethereum’s upgrade to a more secure platform have increased its popularity.

However, negative news can have the opposite effect. If there are security concerns or government restrictions, the Ethereum price in USD can drop quickly. These events make investors worry, causing some to sell their Ethereum, which lowers the price. Staying informed on Ethereum news helps investors make better decisions. Following reputable sources, like financial news websites or official Ethereum channels, can help you track changes in the Ethereum price USD.

Top Apps for Checking Ethereum Price USD Instantly

Many apps make it easy to check Ethereum price USD at any time. Some of the most popular ones include Coinbase, Binance, and CoinMarketCap. These apps offer real-time price updates, so you always know how much Ethereum is worth in USD. Some apps also provide additional tools, like price alerts.

With these alerts, you can set notifications to know when Ethereum hits a specific USD value. This feature is especially helpful for investors who want to react quickly to price changes. Besides tracking the Ethereum price in USD, these apps often have news sections, helping you stay informed. Using trusted apps is a convenient way to monitor your investments and make the best decisions.

Essential Information: Crypto-startup

What’s the Future Prediction for Ethereum Price USD?

Many experts have predictions about Ethereum price USD, but it’s important to remember that these are only estimates. Some analysts believe Ethereum will continue to rise due to its unique technology, especially as more companies and developers use it. The upcoming Ethereum 2.0 upgrade is expected to improve speed and security, which could attract more investors and raise the USD price.

However, market trends can be unpredictable, and prices may still drop depending on demand and external factors. While predictions can give insights, it’s best to consider them carefully. Investing in Ethereum price USD can be rewarding but also comes with risks, so it’s wise to make informed decisions. Ethereum’s future looks bright, and for many, it could be an exciting part of the world of digital money.

Ethereum Price USD: Risks and Rewards of Investing

Investing in Ethereum price USD can offer rewards, but it also carries risks. Ethereum’s price can be volatile, meaning it may increase or decrease rapidly. For new investors, this can be exciting, but it can also be a risk if the price drops unexpectedly. One reward of investing in Ethereum is its growth potential. Many people believe Ethereum’s technology will become more valuable, increasing the USD price over time.

However, like all investments, it’s important to invest only what you’re willing to lose. Risks also include cybersecurity issues and market uncertainty. While Ethereum’s blockchain is secure, cyber-attacks on exchanges can still happen. Being aware of these risks can help you make smarter choices with Ethereum price in USD.

How to Stay Informed About Ethereum Price USD Changes

Staying informed about Ethereum price USD changes is essential for making good investment decisions. One way to do this is by following cryptocurrency news websites and financial news platforms that provide real-time updates. Platforms like Twitter have cryptocurrency experts who share daily insights on Ethereum and other digital assets.

However, it’s important to verify sources, as not all information is accurate. Using apps with price alerts is another effective method. These alerts notify you of significant changes in the Ethereum price in USD, helping you stay up-to-date and react quickly to market trends.

The Impact of Technology on Ethereum Price USD

Technology plays a major role in Ethereum’s value. Innovations like Ethereum 2.0, which aims to improve speed and security, can boost the Ethereum price USD. When new features are introduced, they often attract more investors, raising the price. Ethereum’s technology also enables smart contracts and decentralized applications (DApps), which are becoming popular in various industries.

This versatility increases Ethereum’s demand, potentially pushing up the USD price as more people use its platform. However, technological challenges can affect the price too. If an upgrade has issues, the Ethereum price in USD might drop. Understanding the impact of technology can help investors gauge when to buy or hold their assets. Just like how Bitcoin has become well-known, Ethereum is also growing in popularity and may continue to rise in value.

Tips for Beginners Tracking Ethereum Price USD

For beginners, tracking Ethereum price in USD may feel overwhelming, but there are simple tips to help. First, start by following reliable apps or websites that show accurate price information. This gives you a clear view of Ethereum’s current value. Setting up alerts can also be useful. By receiving updates when the price changes, you can quickly decide when to buy or sell Ethereum.

Many beginner-friendly apps make it easy to set up these alerts without much effort. It’s also helpful to learn the basics of cryptocurrency markets. Understanding trends and market factors affecting Ethereum price USD will improve your confidence and help you make informed choices as a beginner investor.

Conclusion

Ethereum price USD is an exciting and important topic for anyone interested in digital currency. It changes often, influenced by many factors like technology updates, market demand, and global events. By understanding these changes, investors can make smarter choices, whether they’re buying, selling, or holding Ethereum. Learning about how Ethereum works, from its use in smart contracts to its unique blockchain, helps people see why it has value.

For those considering an investment, keeping track of Ethereum price USD can be very helpful. Using tools like apps, news sites, and alerts makes it easier to stay updated and react quickly to price changes. However, it’s important to remember that prices can go up and down, and there’s always some risk involved. Investing responsibly, setting clear goals, and learning as much as possible about Ethereum will help beginners and experts alike make better choices.

Get The Latest Updates On: Important-aspects-of-crypto-exchange-listing

FAQs

What is Ethereum price USD?

Ethereum price USD is the current value of one Ether (ETH) measured in U.S. dollars. This price changes regularly based on market demand and other factors.

Why does Ethereum price USD fluctuate?

Ethereum’s price in USD fluctuates due to factors like market demand, investor interest, technological updates, and global economic events.

How can I check the latest Ethereum price in USD?

You can check the latest Ethereum price in USD on cryptocurrency exchange platforms like Coinbase or Binance, or use apps like CoinMarketCap for real-time updates.

Is Ethereum price USD the same on all platforms?

No, prices may vary slightly across platforms due to fees, market demand, and trading volume differences. However, the variation is generally small.

What affects Ethereum price in USD the most?

The price is mainly influenced by supply and demand, technological developments like Ethereum 2.0, economic conditions, and investor confidence.

Can I buy part of an Ethereum if I can’t afford the full USD price?

Many platforms allow purchases in smaller amounts, so you don’t have to buy a full ETH.

Does Ethereum price USD follow Bitcoin price trends?

Yes, Ethereum often follows Bitcoin’s price trends, but it also has its unique factors that can impact its value independently of Bitcoin.

What is a good time to invest based on Ethereum price in USD?

There is no perfect time, as prices can be unpredictable. Some investors use strategies like dollar-cost averaging to buy Ethereum at different times to balance out the highs and lows.

Is it safe to invest when Ethereum price in USD is low?

Investing when the price is low can be an opportunity, but it also carries risk. Research and setting a budget you’re comfortable with is essential.

Where can I find Ethereum price USD predictions?

You can find predictions on financial news websites, cryptocurrency analysis blogs, and through expert forecasts.

Jennifer David is the creative force behind CelebRiches, your go-to source for celebrity financial exploits. With an unwavering passion for the entertainment industry, she delivers in-depth insights into celebrities’ net worth, combining thorough research with a captivating narrative. Explore the stars’ fiscal journeys through Jennifer’s expert lens, where finance meets fame most engagingly.